常州市江边水泥制品有限公司

电话:0519-85716198

手机:13601506952

传真:0519-85716318

网站:www.czjiangbian.com

邮箱:303845740@qq.com

地址:常州市新北区春江镇魏村沿江东路558号

中国混凝土与水泥制品协会经济运行部

Review and Prospect of Economic Operation of China's Concrete and Cement Products Industry in 2020 Economic Operation Department of China Concrete & Cement-based Products Association

2020年,中国混凝土与水泥制品行业坚决贯彻落实党中央决策部署,努力做好疫情防控,快速实现复工复产,积极参与国家和地方抗疫工程建设,应急保障功能凸显。同时全行业笃行创新发展、绿色发展、智能化发展道路;攻坚克难,加快行业供给侧结构改革和高质量发展,促进行业经济运行实现稳定增长,重点产品产量和主要经济指标再创新高。

一、2020年行业经济运行回顾

(一)主要产量和经济指标概述

1. 主要产量

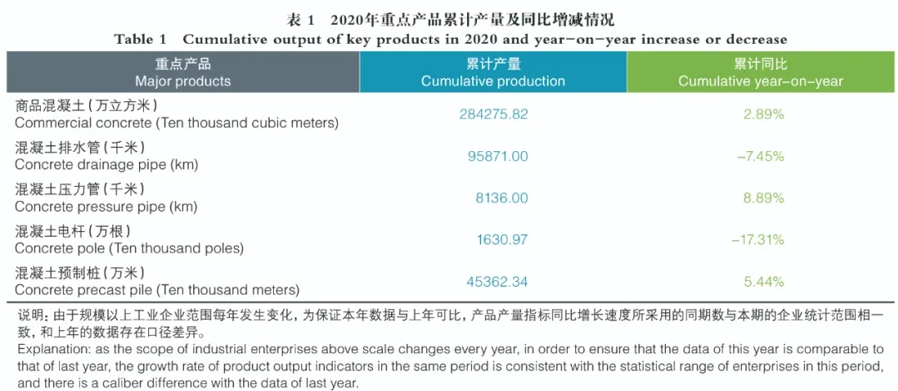

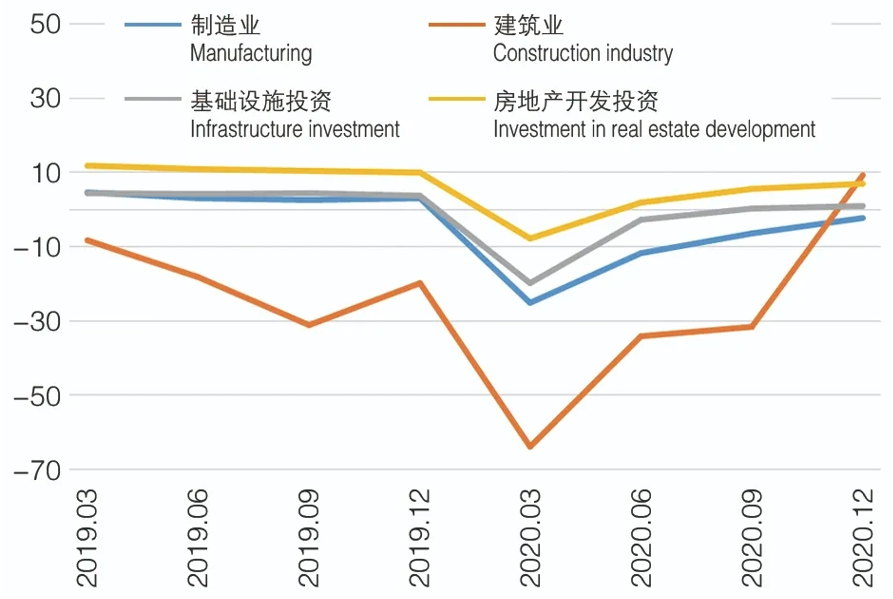

2020年行业重点产品如商品混凝土、混凝土压力管、预制混凝土桩等累计产量均实现同比增长,并创下历史新高(见表1)。

2. 主要经济指标

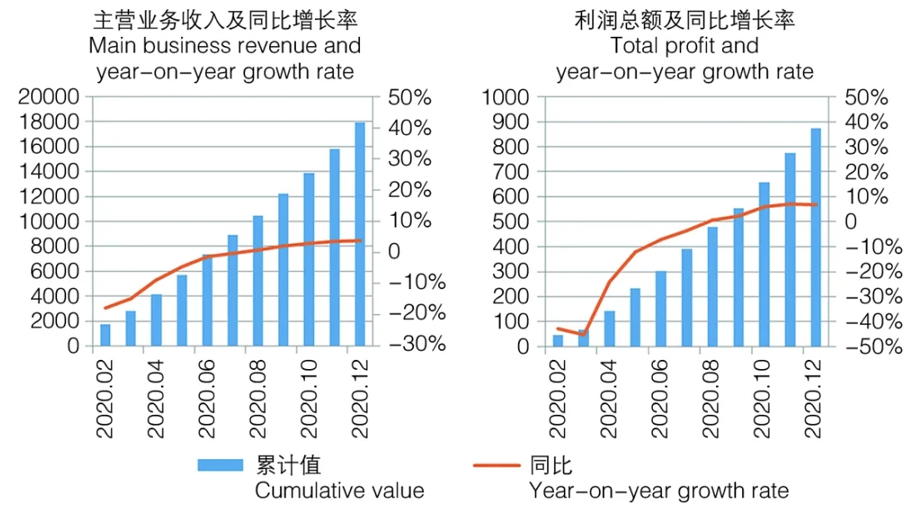

2020年规模以上混凝土与水泥制品工业企业主营业务收入累计17906.51亿元,比上一年增长3.8%;利润总额累计873.33亿元,比上一年增长6.67%。尽管增速较2019年明显降低,但经济总量再创新高。

(二)2020年行业经济运行特点

1. 攻坚克难,彰显责任担当

一季度,在传统淡季叠加疫情因素的双重影响下,由于工期延误、物流受阻、成本上涨,混凝土与水泥制品企业的生产及经营管理均受到严重制约;二季度,在各地区各部门坚决贯彻落实党中央决策部署,科学统筹疫情防控和经济社会发展,扎实做好“六稳”工作、全面落实“六保”任务的背景下,全行业在第一时间复工复产、保障基础建设,快速实现了较高水平的复工复产率。4月底,中国混凝土与水泥制品协会监测的重点预制混凝土桩企业复工复产率达到95%,重点预拌混凝土企业复工复产率达到100%,重点房屋建筑预制混凝土构件企业复工复产率达到100%。

在抗击疫情期间,混凝土与水泥制品企业有力地保障了武汉雷神山、火神山医院,河南版“小汤山医院”,西安市公共卫生中心等地方抗疫工程的建设,凸显了行业在突发情况中的应急保障功能。

2. 供给侧有效发力,保障工程建设进度快速恢复

受疫情影响,2020年一季度重点产品累计产量出现大幅萎缩;4月份开始重点细分行业生产实现快速恢复,重点产品如商品混凝土、预制混凝土桩当月产量实现同比增长;8月份开始个别产品累计产量实现同比增长。

图 1 重点产品2020年单月产量同比增长情况

Figure 1 Growth of monthly output of key products in 2020 compared with the same period last year

从细分产业生产情况来看,商品混凝土作为基建先行产业生产快速恢复,自4月份开始单月产量保持同比增长走势,9月份开始实现累计产量同比增长。分区域来看全国六大区域只有华北地区全年产量出现同比下滑,其余五个区域累计产量均为同比上涨。

房屋建筑预制混凝土构件市场恢复较好,4月份企业生产已恢复甚至超过上一年同期水平,部分地区如陕西、山东、上海、北京等地市场需求好于2019年。据不完全统计,2020年预制混凝土生产企业新增近200家,截止2020年底全国规模在3万立方米以上的预制工厂已超过1200家。

预制混凝土桩企业复工之初经营管理仍存在一定困难,随着交通运输和上下游产业链的逐步恢复,企业生产进度快速提升。下半年市场明显好转,部分地区由于国家基建项目加大投入,预制混凝土桩需求较为旺盛,企业生产快速发力。据不完全统计,2020年新建预制混凝土桩生产厂20家左右,同时受环保节能政策的持续制约以及城市规划的调整需要,部分预制混凝土桩企业停产整顿甚至关停退出市场,整体来看预制混凝土桩生产能力基本与上一年持平。

混凝土管涵企业在疫情中生产经营活动普遍恢复较快,尤其是协会重点监测企业与上一年相比有不同程度的增长。据不完全统计目前我国各种规模混凝土管涵生产企业约5000家。

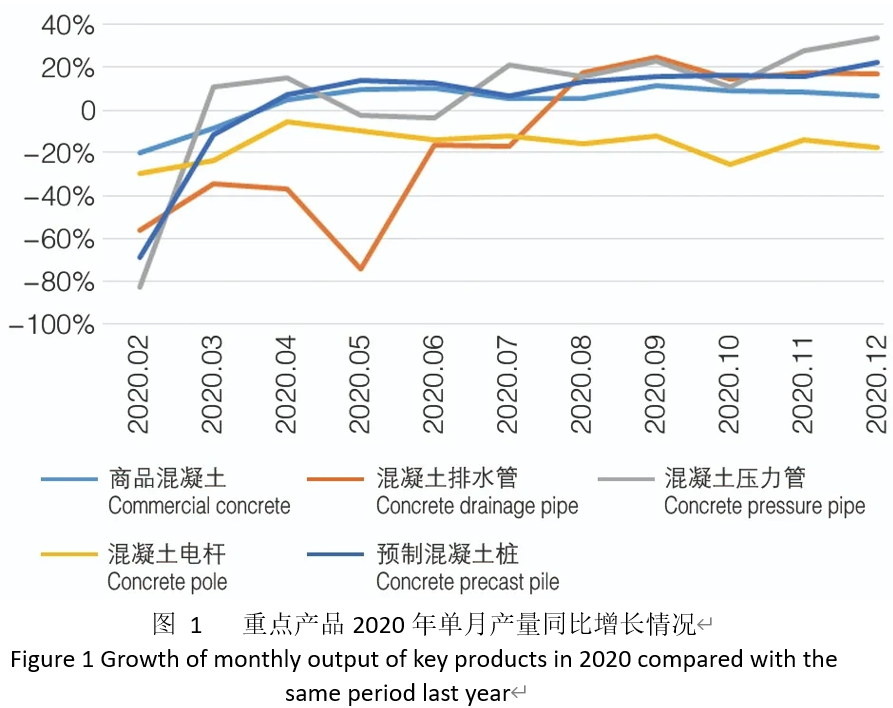

在疫情困境中行业生产的快速恢复有效保障了工程建设进度的提升,2020年前三季度累计固定资产投资增速实现由负转正、全年固定资产投资同比增长2.9%,单季投资增速不断提升、第四季度单季投资增速达到15.67%。

图 2 2020年累计投资及当季投资同比增速(单位:%)

Figure 2 Cumulative investment in 2020 and year-on-year growth rate of investment in the current quarter (unit:%)

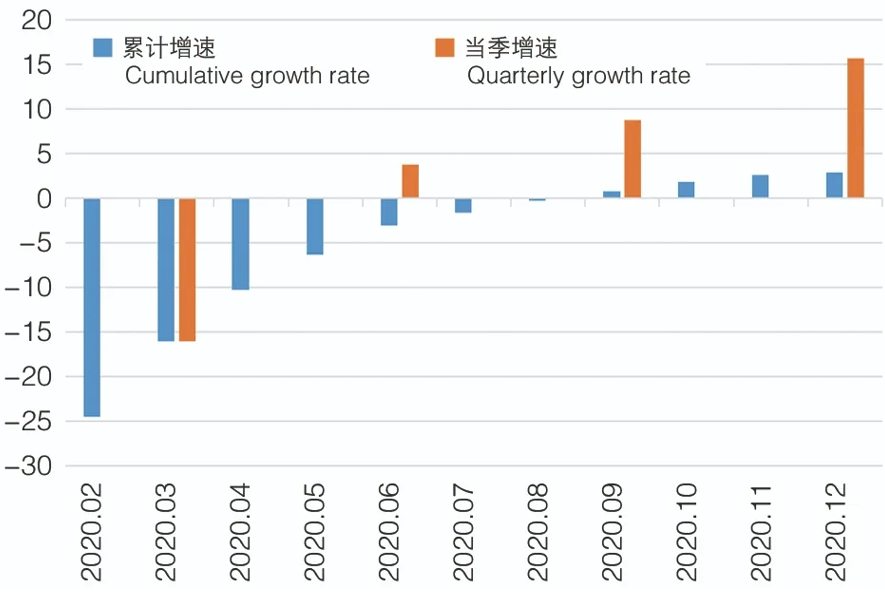

与混凝土与水泥制品行业密切相关的建筑业2020年投资增速则实现近几年最好水平,同比增长9.2%;基础设施投资中的道路运输业、水利管理业投资实现小幅增长;房地产开发投资实现较快增长,全年投资同比增长7.0%。

图 3 重点行业固定资产投资增速走势(单位:%)

Figure 3 Growth trend of fixed asset investment in key industries (unit:%)

从细分数据来看,2020年建筑业房屋建筑施工面积同比增长3.68%,高于2019年1.36个百分点。房地产开发投资中建筑工程投资同比增长8.8%,是拉动房地产开发投资的主要力量;商品房施工面积同比增长3.7%。交通固定资产投资实现较快增长,全年投资预计同比增长7.1%,其中公路水路投资增长10.4%。

3. 价格略有下降,一线与非一线城市存在较大价差

2020年,全国商品混凝土年度均价为437.5元/立方米,较上一年均价低7元/立方米;2020年协会重点监测企业的房屋建筑预制混凝土构件产品价格较上一年也有所下滑。

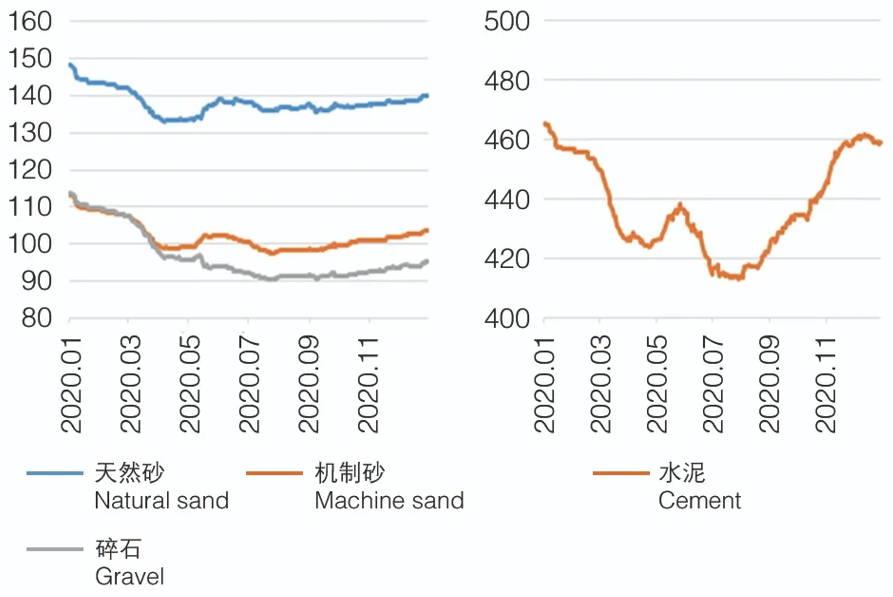

2020年原材料价格出现下滑,从全年走势来看,水泥价格9月份开启第二轮价格上涨,持续到12月底价格再次出现小幅下调;砂石价格4月份结束价格下行走势,开始震荡回升,6~8月南方梅雨季节期间再次震荡回落,9月份再次迈入价格震荡小幅回升通道。

上半年商品混凝土价格保持下行走势,一方面一季度传统淡季价格出现周期性下滑;另一方面疫情导致需求、供给受限,原材料价格在二季度下滑周期出现加速下滑的现象导致商品混凝土价格同步下降。商品混凝土价格上涨滞后于原材料价格1个月左右,国庆节之后才确立价格上行走势。

图 4 2020年原材料价格走势(单位:元/吨)

Figure 4 Raw material price trend in 2020 (unit: yuan per ton)

协会监测数据显示,全国一线城市与非一线城市商品混凝土价格有较明显价差,一线城市均价较非一线城市均价高57元/立方米左右;分地区来看,华北地区一线城市与非一线城市价格差最大,达到62元/立方米,价格差最小的是西北地区,一线城市与非一线城市价格差约为20元/立方米。

从一线城市与非一线城市商品混凝土价格走势来看,2020年下半年华北地区一线城市均价保持下行走势,非一线城市在年末则出现价格上涨走势;四季度华东地区一线城市价格持续小幅上涨,非一线城市则出现先降后涨的走势。同时也可以看出一线城市价格波动活跃程度高于非一线城市,且波动幅度更大。

图 5 2019、2020全国商品混凝土均价走势比较(单位:元/立方米)

Figure 5 Comparison of the average price trend of commercial concrete in China in 2019 and 2020(unit: yuan RMB per cubic meter)

2020年年末全国商品混凝土均价为433元/立方米,较年初下降18元/立方米,全国各省会城市、直辖市年末市场均价及与年初价格比较见表2。

4. 行业经济规模再创新高,成为建材工业重要支撑

在全行业企业克服疫情不利影响的共同努力下,2020年混凝土与水泥制品行业主要经济指标保持了稳定的增长,行业主营业务收入和利润总额双双创历史新高。“十三五”期间混凝土与水泥制品行业收入规模在整个建材工业中保持排名第一,主营业务收入在建材工业中的占比从“十三五”初的16%上升至“十三五”末的32%,是建材工业的重要支撑行业。

图 6 2020年行业主要经济指标变化情况(单位:亿元)

Figure 6 Changes in major economic indicators of the industry in 2020 (unit: 100 million yuan RMB)

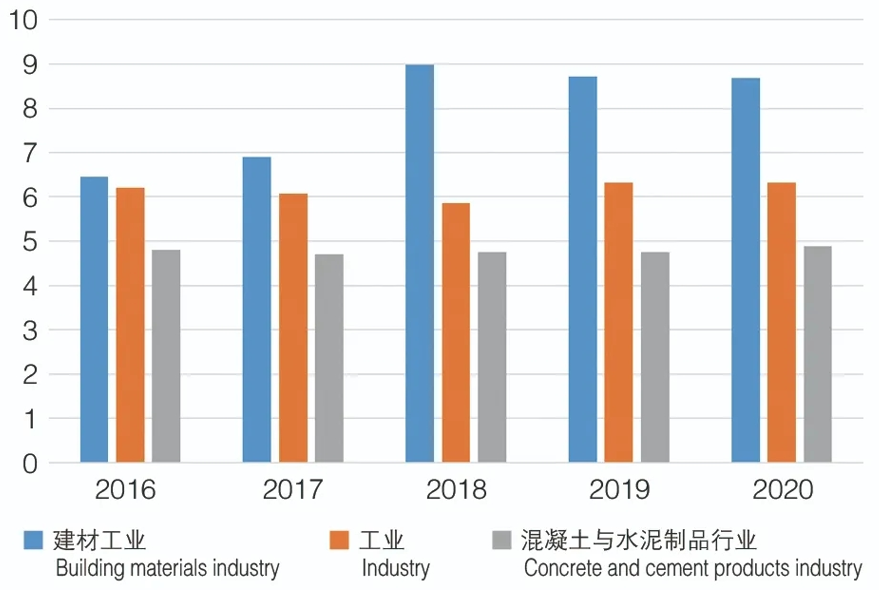

2020年混凝土与水泥制品行业销售利润率为4.88%,较上一年提高0.13个百分点,仍低于整体工业和建材工业平均水平。

图 7 混凝土与水泥制品行业销售利润率仍然偏低

Figure 7 Sales profit margin of concrete and cement products industry is still on the low side

2020年受疫情影响全行业亏损企业面较上一年有所扩大,期末应收账款净额较上一年期末增幅较大,期末应收账款占主营业务收入比例达到38.24%,较上一年提高4.7个百分点。

二、2021年行业发展展望

2020年的新冠疫情推动了“百年未有之大变局”的加速变革,国际关系发生深刻变化;国内经济结构加速构建新发展格局,创新、协调、绿色、开放、共享的新发展理念更加深入人心。展望2021年,混凝土与水泥制品行业在准确识变的基础上将走上科学应变、笃定创新的更加健康可持续的发展之路。

(一)疫情凸显宏观经济韧性,支撑各产业结构持续优化

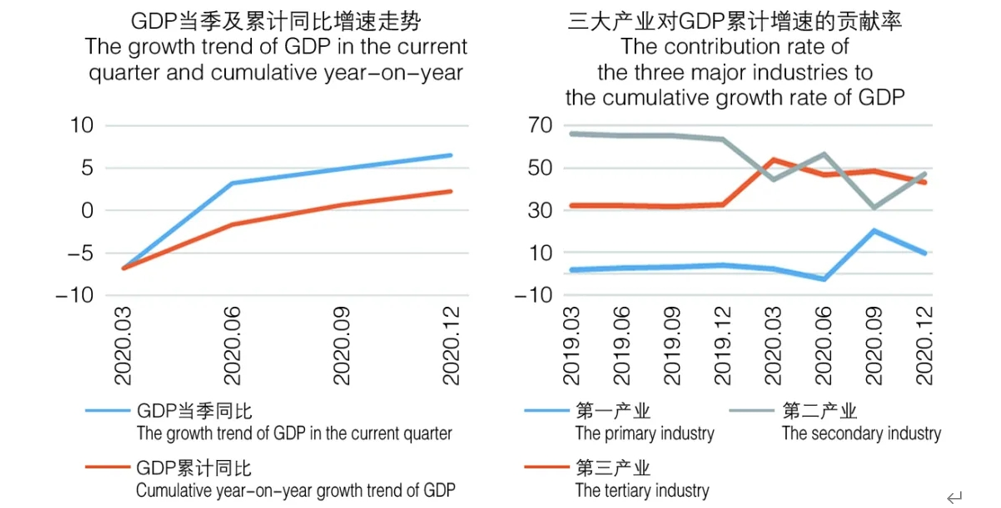

2020年全国统筹疫情防控和经济社会发展取得了重大成果,GDP迈上百万亿元新台阶,同比增长2.3%,成为全球唯一实现经济正增长的主要经济体。分季度来看,一至四季度GDP增速分别为-6.8%、3.2%、4.9%和6.5%,经济超预期恢复,显示出我国经济发展的强大韧性。

图 8 2020年GDP增长及三大产业对GDP增长的贡献率(单位:%)

Figure 8 GDP growth in 2020 and the contribution rate of the three major industries to GDP growth (unit:%)

从产业结构来看,疫情对第三产业的影响较大,2020年第三产业GDP同比增速从上一年的7.2%下滑至2.1%,第二产业GDP同比增速从上一年的4.9%下滑至2.6%,第一产业GDP增速变化不大。2020年,经济结构继续优化,第三产业对经济的支撑作用仍占主导地位,在GDP占比中达到54.5%,因此第三产业GDP的增长主导了全国经济总量的增长方向;第二产业发挥了较好的支撑作用,工业生产恢复较好同时结构持续优化,制造业稳步增长奠定了良好的经济恢复基础,高技术制造业继续发挥新动能优势拉高工业增加值增长速度。

图 9 制造业带动工业增加值增速稳步恢复(单位:%)

Figure 9 The manufacturing industry led the steady recovery of the growth rate of industrial value added (unit:%)

制造业回升明显,2020年制造业增加值增长3.4%,高于整体规上工业增加值增长率0.6个百分点,有力带动了工业生产稳步恢复。其中装备制造业增加值增长6.6%,持续发挥重要支撑作用;高技术制造业增加值增长7.1%,新兴产品增长强劲。

在此宏观经济环境下,混凝土与水泥制品行业顺势而为,产业结构将得到不断优化。

(二)优化营商环境政策频发,有利于企业更好发挥活力

近几年,国家层面不断出台优化营商环境的相关法规政策,我国营商环境明显改善。2020年受疫情影响,企业困难加剧,亟需进一步聚焦市场主体关切采取更多改革的办法破解企业生产经营中的堵点痛点,国务院办公厅及时发布了《关于进一步优化营商环境更好服务市场主体的实施意见》,依托大数据、人工智能等互联网科技提升企业经营便利化。

在政策的持续推动下,在构建“国内大循环为主体、国内国际双循环相互促进”新发展格局的战略下,国内市场主体活力得到大力激发与提升。混凝土与水泥制品行业民营企业数量众多,在政策支持下将能够更好地发挥市场经济主体的主动性和积极性,为国内大循环、国内国际双循环新发展格局做出贡献。

(三)绿色发展深入推进,固废利用成为行业使命和新增长点

在绿色发展战略的持续推动下,混凝土与水泥制品行业从资源保护、污染防治、节能减排、固废处理和利用、生态修复等各个方面也在不断践行绿色发展理念,绿色发展早已成为全行业发展的共识。

2020年政府提出了碳峰值和碳中和承诺,2021年2月22日国务院发布《关于加快建立健全绿色低碳循环发展经济体系的指导意见》(以下简称《意见》),提出到2025年绿色低碳循环发展的生产体系、流通体系、消费体系初步形成;到2035年美丽中国建设目标基本实现。《意见》提出“健全绿色低碳循环发展的生产体系”,首当其冲的是推进工业绿色升级,加快实施建材等行业的绿色化改造;促进工业固体废物综合利用;全面推行清洁生产等等。

绿色低碳循环发展的相关政策必将大力推动全社会尤其是重点行业低碳发展的步伐,混凝土与水泥制品行业减碳、用碳技术创新也将得到加速推动;同时作为重要的利废行业,混凝土与水泥制品行业的固废综合利用技术和应用推广也将得到大力发展,并带来新的经济增长。

(四)工业互联网快速发展,行业智能制造转型将取得突破

随着国家不断深入推进工业与互联网、信息化、智能化的融合,工业互联网技术不断突破,2020年12月工信部印发《工业互联网创新发展行动计划(2021-2023年)》,未来三年将是我国工业互联网快速成长的关键期。

2020年9月,工信部办公厅印发《建材工业智能制造数字转型行动计划(2021-2023年)》提出了建材工业信息化、智能制造的发展目标:到2023年,建材工业信息化基础支撑能力显著增强,智能制造关键共性技术取得明显突破,重点领域示范引领和推广应用取得较好成效,全行业数字化、网络化、智能化水平大幅提升,经营成本、生产效率、服务水平持续改进,推动建材工业全产业链高级化、现代化、安全化,加快迈入先进制造业。

针对重点细分行业提出了重点建设任务:混凝土及水泥制品行业要重点形成制造执行管理、智能物流配送、在线质量监测的混凝土全产业链集成系统解决方案,以及集中搅拌分送、自动成型控制、骨架焊接运送、制品智能养护的水泥制品集成系统解决方案。利用新一代信息通信技术融合场景方向方面,提出要运用建筑信息模型技术促进建材和建筑无缝连接,大力发展部品化建材,实现建材全生命周期可追溯、可预测、可维护、可回收。

《建材工业智能制造数字转型行动计划(2021-2023年)》提出了建材工业智能化、数字化转型总体目标和具体建设任务,在国家不断深化产融合作、加大政策支持的保障下,混凝土与水泥制品行业的数字化、智能化转型将取得突破。

(五)响应国家“十四五”规划,创新驱动行业高质量发展全面升级

《混凝土与水泥制品行业“十四五”发展指南》(初稿)指出“十四五”是混凝土与水泥制品行业转换发展动能、改变发展方式,逐步转向高端、高附加值、高质量发展的重要时期,以5G、人工智能、云计算、大数据、新能源、数字经济、共享经济等为代表的新一轮科技革命深入推进,为行业高质量发展提供了创新要素支撑。

可以预见“十四五”开局之际,混凝土与水泥制品行业将掀起惟实励新的高潮:从制度和机制创新为切入点,以关键技术攻关为突破口,通过应用创新建立更完善的“生态圈”,实现产品附加值的提升,最终实现全行业的创新全面升级、实现全行业的高端化发展,全面完成行业“十四五”发展目标。

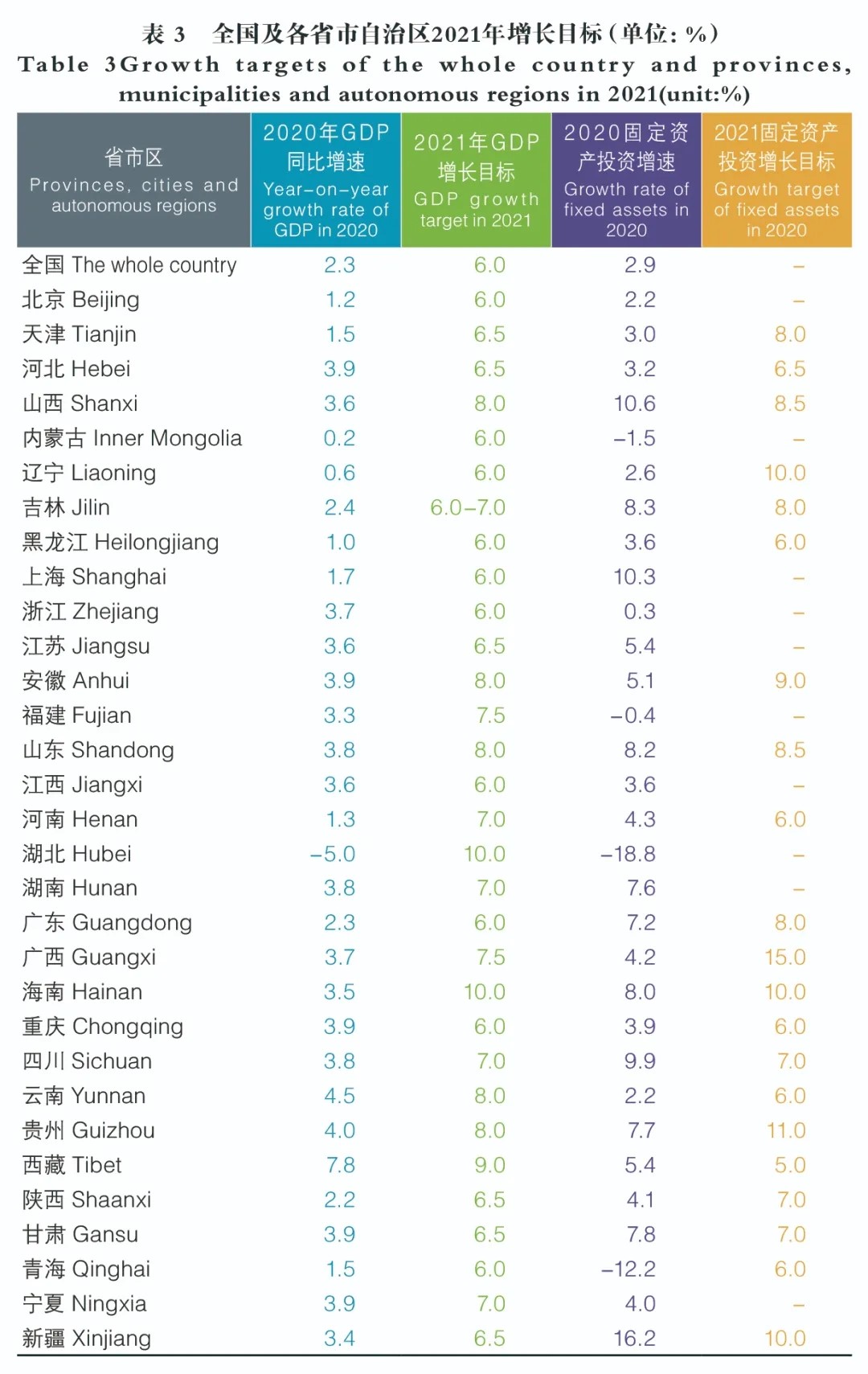

(六)2021年经济增长目标确定,投资提速利好行业发展

2021年1月以来,全国各地两会陆续召开,政府工作报告相继出炉,提出了较高的经济增长目标。2020年疫情对几乎所有省市自治区的经济增长和固定资产投资都产生了较大影响,在基数较低的背景下,各省市制定的2021年经济增长与固定资产投资增长目标较2020年实际水平均出现明显提升,例如湖北提出10%的经济增长目标是底线要求、并会尽最大努力去争取更好结果,广西、海南、云南2021年固定资产投资预期增长目标均超过10%。

2021全国两会政府工作报告提出2021年重点工作要坚持稳中求进的总基调,经济增速目标为6%以上,保持宏观政策连续性稳定性可持续性,促进经济运行在合理区间;坚持扩大内需这个战略基点,充分挖掘国内市场潜力,扩大有效投资,在更多领域让社会资本进得来、能发展、有作为。

2021年是“十四五”开局之年。可以预见,在构建新发展格局、推动高质量发展的主题下,为确保经济增长目标,促进区域协调发展的重大工程建设以及涉及民生领域的水利、交通、老旧小区改造、城镇化建设、乡村振兴建设及新基建投资力度将明显加大,这将为2021年混凝土与水泥制品行业提供较好的需求空间,为企业创新升级提供保障和动力,企业生产和经济规模将稳步提升,从而提高整个行业优化升级发展的水平。

In 2020, China's concrete and cement products industry resolutely implemented the decisions and arrangements of the CPC Central Committee, shrived to do a good job in epidemic prevention and control, quickly returned to work and production, and actively participated in the construction of national and local anti-epidemic projects. At the same time, the whole industry adhered to the road of innovative development, green development and intelligent development, overcomed difficulties, accelerated the reform of the supply-side structure and high-quality development of the industry, and promoted the stable growth of the economic operation of the industry. The output of key products and major economic indicators hit the new high.

1 Review of the Economic Operation of the Industry in 2020

1.1 Overview of main output and economic indicators

(1) Main output

In 2020, the cumulative output of key products in the industry, such as commercial concrete, concrete pressure pipes and precast concrete piles, increased year-on-year and reached an all-time high (see table 1).

(2) Main economic indicators

In 2020, the main business income of large-scale concrete and cement products industrial enterprises totaled 1.790651 trillion yuan RMB, an increase of 3.8% over the last year, and the total profit totaled 87.333 billion yuan RMB, an increase of 6.67% over last year. Although the growth rate is significantly lower than in 2019, the economy has reached a new high.

1.2 The characteristics of the economic operation of the industry in 2020

(1) Overcoming difficulties and showing responsibility

In the first quarter, under the dual influence of the traditional off-season superimposed epidemic factors, the production and management of concrete and cement products enterprises were seriously restricted due to the delay of construction period, the hindrance of logistics and the rise of cost. In the second quarter, under the background of resolutely implementing the decisions and arrangements of the CPC Central Committee, scientifically coordinating epidemic prevention and control and economic and social development, doing a solid job of "six stability" and fully implementing the tasks of "six guarantees," the whole industry resumed work and ensured infrastructure construction at the first time, and quickly achieved a relatively high rate of resumption of work. At the end of April, the resumption rate of key precast concrete pile enterprises monitored by China concrete and cement-based products association reached 95%, and the key ready-mixed concrete enterprises reached 100%, the resumption rate of precast concrete components in key housing construction reached 100%.

During the fighting against the epidemic, concrete and cement products enterprises effectively guaranteed the construction of anti-epidemic projects in places such as Leishenshan and Huoshenshan Hospital in Wuhan, Xiaotangshan Hospital in Henan version, and Xi'an Public Health Center, highlighting the emergency guarantee function of the industry in emergencies.

(2) Effective force on the supply side to ensure the rapid recovery of the construction progress of the project

Affected by the epidemic, the cumulative output of key products shrank sharply in the first quarter of 2020. Since April, the production of key industry segments has been restored rapidly, and the monthly output of key products such as commercial concrete and precast concrete piles increased year-on-year. Since August, the cumulative output of individual products increased compared with the same period last year.

From the point of view of the production of subdivided industries, the production of ready-mixed concrete as the leading industry of capital construction has recovered rapidly, and the monthly output has maintained the trend of year-on-year growth since April, and the cumulative output has increased year-on-year since September. From a sub-regional point of view, in the six major regions of China, only North China showed a year-on-year decline, while the cumulative output of the other five regions increased year-on-year.

The market of precast concrete components for housing construction has recovered well, and the production of enterprises in April has recovered or even exceeded the level of the same period of the previous year, and the market demand in some areas such as Shaanxi, Shandong, Shanghai and Beijing is better than that in 2019. According to incomplete statistics, there are nearly 200 new precast concrete production enterprises in 2020, and there are more than 1200 prefabricated factories with a scale of more than 30, 000 cubic meters by the end of 2020.

At the beginning of the resumption of the work in precast concrete pile enterprises, there were still some difficulties in business management. With the gradual recovery of transportation and upstream and downstream industrial chains, the production progress of enterprises has improved rapidly. The market has obviously improved in the second half of the year. Due to the increased investment in national infrastructure projects in some areas, the demand for precast concrete piles is relatively strong, and the production of enterprises is developing rapidly. According to incomplete statistics, about 20 new precast concrete pile production plants were built in 2020. At the same time, due to the continuous restriction of environmental protection and energy conservation policies and the adjustment needs of urban planning, some precast concrete pile enterprises stopped production for rectification or even closed down from the market. On the whole, the production capacity of precast concrete piles is basically the same as that of the previous year.

The production and operation activities of concrete pipe and culvert enterprises generally recovered quickly in the epidemic situation, especially the key monitoring enterprises of the association increased to varying degrees compared with the previous year. According to incomplete statistics, there are about 5000 concrete pipe culvert production enterprises of various sizes in our country at present.

In the plight of the epidemic, the rapid recovery of industrial production effectively ensured the improvement of the progress of the project construction. In the first three quarters of 2020, the growth rate of cumulative fixed asset investment changed from negative to positive, and the annual fixed asset investment increased by 2.9% compared with the same period last year. The growth rate of investment in a single quarter continued to increase, and the growth rate of investment in a single quarter reached 15.67% in the fourth quarter.

In 2020, investment in the construction industry, which is closely related to the concrete and cement products industry, grew at the best rate in recent years, with an increase of 9.2% over the same period last year. Investment in road transport and water conservancy management industries in infrastructure investment grew slightly; and investment in real estate development grew rapidly, with an annual investment growth rate of 7.0% over the same period last year.

According to the breakdown data, the construction area of the construction industry increased by 3.68% in 2020 compared with the same period last year, which is 1.36% higher than that in 2019. Among the real estate development investment, the construction investment increased by 8.8% compared with the same period last year, which is the main force to promote the real estate development investment; the construction area of commercial housing increased by 3.7% over the same period last year. Investment in transportation fixed assets has achieved relatively rapid growth, and investment for the whole year is expected to grow by 7.1% compared with the same period last year, of which highway and waterway investment increased by 10.4%.

(3) The price has dropped slightly, and there is a large price difference between first-tier and non-first-tier cities

In 2020, the annual average price of commercial concrete was 437.5 yuan RMB per cubic meter, which was 7 yuan RMB per cubic meter lower than that of the previous year. The price of precast concrete components of housing construction in key monitoring enterprises of the association also declined compared with the previous year in 2020.

The price of raw materials declined in 2020, especially cement, began the second round of price rise in September and continued to decline slightly again until the end of December. The price of sand and gravel ended its downward trend in April and began to shock and pick up, it fluctuated again during the southern plum rain season from June to August, and entered the channel of price shock and slight recovery again in September.

Commercial concrete prices maintained a downward trend in the first half of the year. On the one hand, traditional off-season prices declined periodically in the first quarter; on the other hand, the epidemic led to limited demand and supply, and the accelerated decline in raw material prices in the second quarter led to a simultaneous decline in commercial concrete prices. The rise in the price of commercial concrete lags behind the price of raw materials for about a month, and the upward trend of prices was not established until after the National Day.

Association monitoring data show that there is an obvious price difference in commercial concrete prices between first-tier cities and non-first-tier cities across the country, and the average price in first-tier cities is about 57 yuan RMB per cubic meter higher than that in non-first-tier cities. From a regional point of view, the price difference between first-tier cities and non-first-tier cities in North China is the largest, reaching 62 yuan RMB per cubic meter, the smallest price difference is in the northwest region, and the price difference between first-tier cities and non-first-tier cities is about 20 yuan RMB per cubic meter.

Judging from the price trend of commercial concrete in first-tier cities and non-first-tier cities, the average price of first-tier cities in North China maintained a downward trend in the second half of 2020, while the prices in non-first-tier cities increased at the end of the year. The prices in first-tier cities in East China continued to rise slightly in the fourth quarter, while those in non-first-tier cities showed a trend of falling first and then rising. At the same time, it can also be seen that the activity of price fluctuation in first-tier cities is higher than that in non-first-tier cities, and the fluctuation range is greater.

At the end of 2020, the average price of commercial concrete in China is 433 yuan RMB per cubic meter, which is 18 yuan RMB per cubic meter lower than that at the beginning of the year. The average market prices of provincial capitals and municipalities directly under the Central Government at the end of 2020 and the prices at the beginning of the year are as table 2.

(4) The economic scale of the industry has reached a new high and has become an important support for the building materials industry

With the joint efforts of enterprises in the whole industry to overcome the adverse effects of the epidemic, the main economic indicators of the concrete and cement products industry maintained steady growth in 2020, both the main business income and total profits of the industry reached record highs. During the 13th five-year Plan period, the income scale of the concrete and cement industry ranked first in the whole building materials industry, and the proportion of main business income in the building materials industry rose from 16% at the beginning of the 13th five-year Plan to 32% at the end of the 13th five-year Plan, which is an important supporting industry for the building materials industry.

In 2020, the sales profit margin of the concrete and cement products industry was 4.88%, an increase of 0.13% over the previous year, still lower than the average level of the overall industry and building materials industry.

In 2020, the loss-making enterprises in the whole industry affected by the epidemic expanded compared with the previous year, and the net accounts receivable at the end of the period increased significantly compared with the end of the previous year, the proportion of accounts receivable to the main business income reached 38.24%, an increase of 4.7% over the previous year.

2 Prospects for the Development of the Industry in 2021

The epidemic of COVID-19 in 2020 promoted the accelerated change of "great changes not seen in a century", and profound changes took place in international relations. The domestic economic structure accelerated the construction of a new development pattern, and the new development concept of innovation, coordination, green, openness and sharing was more deeply rooted in the hearts of the people. Looking forward to 2021, the concrete and cement products industry will embark on a more healthy and sustainable development road of scientific response and firm innovation on the basis of accurate understanding of change.

2.1 The epidemic highlights macroeconomic resilience and supports the continuous optimization of various industrial structures

Great achievements have been made in the prevention and control of epidemic situation and economic and social development throughout the country in 2020. GDP reached a new level of 100 trillion yuan RMB, an increase of 2.3% over the same period of last year, making it the only major economy in the world to achieve positive economic growth. From a quarterly point of view, the GDP growth rate from the first to the fourth quarter was-6.8%, 3.2%, 4.9% and 6.5% respectively, and the economy recovered faster than expected, showing the strong resilience of China's economic development.

From the perspective of industrial structure, the epidemic has a great impact on the tertiary industry. In 2020, the year-on-year growth rate of GDP in the tertiary industry dropped to 2.1% from 7.2% in the previous year, and the GDP growth rate in the secondary industry dropped to 2.6% from 4.9% in the previous year, the GDP growth rate of the primary industry has not changed much. In 2020, the economic structure continued to be optimized, and the tertiary industry still played a leading role in supporting the economy, accounting for 54.5% of GDP. Therefore, the growth of GDP of the tertiary industry dominated the growth direction of the national economy. The secondary industry played a better supporting role, the industrial production recovered well while the structure was continuously optimized, the steady growth of the manufacturing industry laid a good foundation for economic recovery, and the high-tech manufacturing industry continued to give full play to the advantage of new momentum to increase the growth rate of industrial added value.

The manufacturing industry rebounded significantly, and the added value of the manufacturing industry grew by 3.4% in 2020, which was 0.6% higher than the overall growth rate of industrial added value, which strongly led to the steady recovery of industrial production. Among them, the added value of the equipment manufacturing industry grew by 6.6%, which continued to play an important supporting role. The added value of the high-tech manufacturing industry grew by 7.1%, and the growth of emerging products was strong.

In this macroeconomic environment, the concrete and cement products industry conforms to the trend, and the industrial structure will be continuously optimized.

2.2 The frequent occurrence of policies to optimize the business environment will help enterprises to give full play to their vitality

In recent years, relevant regulations and policies to optimize the business environment have been continuously introduced at the national level, and the business environment in China has improved significantly. Affected by the epidemic in 2020, the difficulties of enterprises intensified, and there is an urgent need to further focus on the concerns of market participants and adopt more reform measures to solve the pain points in the production and operation of enterprises. the General Office of the State Council promptly issued The implementation opinions on further optimizing the business environment and better serving market entities, relying on internet technologies such as big data and artificial intelligence to improve business facilitation.

Under the continuous promotion of the policy and the strategy of building a new development pattern of "domestic cycle as the main body, domestic and international double cycles promote each other", the vitality of the main body of domestic market has been greatly stimulated and promoted. There are a large number of private enterprises in concrete and cement products industry, with the support of policies, they will be able to give better play to the initiative and enthusiasm of the main body of the market economy and contribute to the new development pattern of domestic and international circulation.

2.3 With the further promotion of green development, the utilization of solid waste has become the mission and new growth point of the industry

Under the continuous promotion of the green development strategy, the concrete and cement products industry is constantly implementing the concept of green development from the aspects of resource protection, pollution prevention, energy saving and emission reduction, solid waste treatment and utilization, ecological restoration and so on, green development has already become the consensus of the development of the whole industry.

The government put forward the promise of carbon peak and carbon neutralization in 2020, on February 22, 2021, the State Council issued The guidance on speeding up the establishment and improvement of a green and low-carbon circular development economic system (hereinafter referred to as the opinion). It is proposed that the production system, circulation system and consumption system of green and low-carbon circular development will be initially formed by 2025, and the goal of building a beautiful China will be basically achieved by 2035. The opinion put forward"perfecting the production system of green and low-carbon circular development",in which the first thing is to promote the green upgrading of industry, speed up the implementation of green transformation of building materials and other industries, promote the comprehensive utilization of industrial solid waste, and carry out cleaner production in an all-round way.

The relevant policies of green and low-carbon circular development will vigorously promote the low-carbon development of the whole society, especially the key industries, and the technological innovation of carbon reduction and carbon use in the concrete and cement products industry will also be accelerated. At the same time, as an important industry of waste utilization, the solid waste comprehensive utilization technology and application promotion of concrete and cement products industry will also be vigorously developed, and bring new economic growth.

2.4 With the rapid development of industrial internet, the transformation of intelligent manufacturing in the industry will make a breakthrough

With the continuous promotion of the integration of industry and internet, information technology and intelligence, and the continuous breakthroughs in industrial internet technology, the Ministry of Industry and Information Technology issued the Industrial Internet innovation and development action plan (2021-2023) in December 2020, the next three years will be the key period for the rapid growth of China's industrial internet.

In September 2020, the General Office of the Ministry of Industry and Information Technology issued the Action plan for digital transformation of intelligent manufacturing in building materials industry (2021-2023), which put forward the development goal of informatization and intelligent manufacturing in building materials industry, that is, by 2023, the basic supporting capacity of informatization in building materials industry has been significantly enhanced, the key common technologies of intelligent manufacturing have made obvious breakthroughs, and good results have been achieved in demonstration, guidance, promotion and application in key areas,the level of digitalization, networking and intelligence of the whole industry has been greatly improved, and the operating cost, production efficiency and service level have been continuously improved, promoting the upgrading, modernization and safety of the whole industrial chain of the building materials industry, and speeding up the entry into advanced manufacturing industry.

Aiming at the key subdivided industries, key construction tasks are put forward: The concrete and cement products industry should focus on forming a concrete industry chain integrated system solution of manufacturing execution management, intelligent logistics and distribution, and on-line quality monitoring, and the cement products integrated system solution of centralized mixing and distribution, automatic forming control, skeleton welding and transportation, and intelligent maintenance of products. In the aspect of using the new generation of information and communication technology to integrate the scene direction, it is proposed that the building information model technology should be used to promote the seamless connection between building materials and buildings, and vigorously develop compartmentalized building materials to achieve traceability, predictability, maintainability and recycling of the whole life cycle of building materials.

The action plan for digital transformation of intelligent manufacturing in building materials industry (2021-2023) puts forward the overall objectives and specific construction tasks of intelligent and digital transformation of building materials industry. Under the guarantee of deepening industry-finance cooperation and increasing policy support, the digital and intelligent transformation of concrete and cement products industry will make a breakthrough.

2.5 In response to the National 14th five-year Plan, innovation-driven industries will be upgraded in an all-round way

The Guide to the development of concrete and cement products industry during the 14th five-year Plan (the first draft) points out that the 14th five-year Plan is an important period for the concrete and cement products industry to change its development momentum and mode of development, and gradually shift to high-end, high value-added and high-quality development. A new round of scientific and technological revolution represented by 5G, artificial intelligence, cloud computing, big data, new energy, digital economy and sharing economy has been further promoted which provides innovative elements support for the high-quality development of the industry.

It can be predicted that at the beginning of the 14th five-year Plan, the concrete and cement products industry will set off the most exciting part, such as from the system and mechanism innovation as the starting point, to tackle key technologies as the breakthrough, through the application of innovation to establish a more perfect "ecosystem", to enhance the added value of products, and finally to achieve the overall upgrading of innovation and high-end development of the whole industry, and to fully complete the development goal of the industry's 14th five-year Plan.

2.6 The target of economic growth in 2021 will be set, the acceleration of investment will be good for the development of the industry

Since January 2021, the two conferences across the country have been held one after another, and the government work reports have been released one after another, putting forward higher economic growth targets. The epidemic in 2020 had a great impact on economic growth and fixed asset investment in almost all provinces, cities and autonomous regions. Under the background of a low base, the economic growth and fixed asset investment growth targets set by provinces and cities in 2021 are significantly higher than the actual level in 2020. For example, the economic growth target of 10% is the bottom line requirement and will do its best to strive for better results in Hubei. Fixed asset investment in Guangxi, Hainan and Yunnan is expected to grow by more than 10% in 2021.

Government work report of the two sessions of the National people's Congress in 2021 proposed that the key work in 2021 should adhere to the general tone of seeking progress in the midst of stability, with an economic growth target of more than 6%, maintain the continuity, stability and sustainability of macro policies, and promote economic operation in a reasonable range; adhere to the strategic basic point of expanding domestic demand, fully tap the potential of the domestic market, expand effective investment, and enable social capital to enter, develop and make a difference in more areas.

2021 is the opening year of the 14th five-year Plan. It can be predicted that under the theme of building a new development pattern and promoting high-quality development, in order to ensure the goal of economic growth, major projects to promote coordinated regional development, as well as water conservancy, transportation, renovation of old residential areas, urbanization, rural revitalization and new infrastructure investment in the fields of people's livelihood will be significantly increased, which will provide a better demand space for the concrete and cement products industry in 2021, and provide guarantee and motivation for the innovation and upgrading of enterprises. Enterprise production and economic scale will increase steadily, so as to improve the level of optimization and upgrading development of the whole industry.

文章来源:原文参见《混凝土世界》2021年03期 P8~P20

Article source:See the original text in Concrete World, No. 03, P8~P20, 2021